Wyoming Credit: Reliable Financial Solutions for Every Stage of Life

Wyoming Credit: Reliable Financial Solutions for Every Stage of Life

Blog Article

Why You Ought To Select Lending Institution for Financial Security

Cooperative credit union stand as pillars of financial stability for numerous individuals and communities, offering an unique approach to banking that prioritizes their participants' health. Their dedication to decrease charges, competitive rates, and personalized customer support establishes them in addition to typical financial institutions. However there's more to credit history unions than just financial perks; they additionally cultivate a feeling of neighborhood and empowerment amongst their members. By picking debt unions, you not just safeguard your monetary future but likewise enter into an encouraging network that values your economic success.

Lower Charges and Competitive Rates

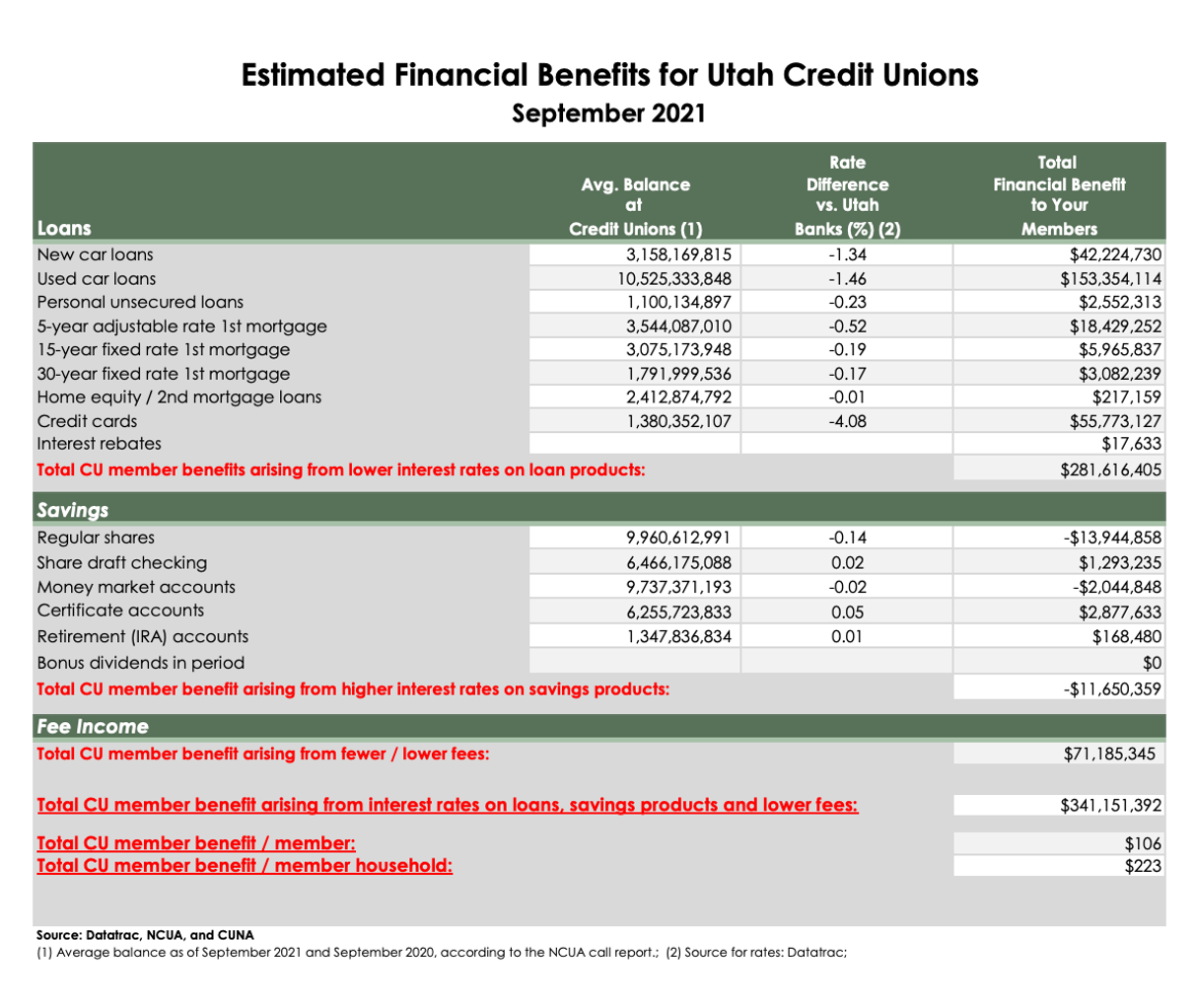

Credit rating unions commonly use reduced costs and affordable rates compared to typical financial institutions, providing consumers with a more solvent alternative for handling their funds. One of the essential benefits of cooperative credit union is their not-for-profit structure, enabling them to focus on participant advantages over optimizing revenues. This difference in emphasis allows lending institution to supply lower costs for services such as checking accounts, savings accounts, and financings. Additionally, lending institution commonly supply much more competitive rate of interest on interest-bearing accounts and lendings, equating to much better returns for participants and lower loaning costs.

Personalized Customer Care

Offering customized aid and individualized services, debt unions prioritize individualized client solution to meet participants' certain economic demands effectively. Credit scores union personnel frequently take the time to listen diligently to members' concerns and give personalized referrals based on their private demands.

One trick element of customized client solution at cooperative credit union is the concentrate on economic education. Credit score union agents are dedicated to aiding participants recognize various monetary products and services, empowering them to make educated decisions (Credit Union Cheyenne). Whether a member is aiming to open an interest-bearing account, use for a financing, or strategy for retirement, cooperative credit union supply customized advice every step of the way

Moreover, lending institution frequently go above and beyond to make certain that their participants really feel valued and supported. By building solid relationships and promoting a feeling of neighborhood, credit rating unions create an inviting environment where members can trust that their monetary health remains in excellent hands.

Solid Area Focus

With a commitment to cultivating regional links and supporting area initiatives, cooperative credit union focus on a solid neighborhood emphasis in their operations - Wyoming Credit Unions. Unlike standard financial institutions, lending institution are member-owned banks that operate for the advantage of their members and the neighborhoods they serve. This distinct structure enables lending institution to concentrate on the wellness of their members and the regional area as opposed to entirely on producing revenues for external investors

Credit unions frequently engage in various community outreach programs, sponsor local events, and collaborate with various other companies to deal with community needs. By investing in the area, credit rating unions help promote local economies, develop job possibilities, and boost total top quality of life for locals. Additionally, credit score unions are known for their participation in monetary proficiency programs, using academic resources and workshops to assist neighborhood participants make notified financial decisions.

Financial Education And Learning and Assistance

In advertising monetary proficiency and using support to individuals in requirement, debt unions play a vital duty in empowering communities in the direction of financial security. One of the crucial advantages of credit rating unions is their emphasis on providing economic education and learning to their members.

Additionally, cooperative credit union often provide aid to members facing economic difficulties. Whether it's via low-interest loans, adaptable payment plans, or financial therapy, credit scores unions are dedicated to assisting their participants overcome obstacles and achieve monetary stability. This personalized Check Out Your URL approach sets debt unions apart from standard financial institutions, as they focus on the monetary health and wellness of their members most importantly else.

Member-Driven Decision Making

Participants of cooperative credit union have the opportunity to voice their point of views, supply comments, and even compete positions on the board of supervisors. This degree of interaction cultivates a feeling of ownership and community among the members, as they have a direct effect on the instructions and policies of the lending institution. By actively entailing participants in decision-making, cooperative credit union can better tailor their services to fulfill the unique demands of their neighborhood.

Inevitably, member-driven decision making not just improves the total participant experience however additionally promotes transparency, trust, and responsibility within the debt union. It showcases the cooperative nature of lending institution and their commitment to offering the very best rate of interests of their participants.

Conclusion

Finally, cooperative credit union supply an engaging option for economic security. With lower fees, competitive rates, customized consumer solution, a strong area focus, and a commitment to monetary education and support, cooperative credit union prioritize participant advantages and empowerment. With member-driven decision-making procedures, credit rating unions advertise transparency and liability, ensuring a steady financial future for their members.

Credit unions stand as columns of financial stability for several individuals and neighborhoods, supplying a distinct technique site to financial that prioritizes their members' wellness. Unlike typical banks, credit report unions are member-owned economic institutions that operate for the advantage of their participants and the areas they serve. Furthermore, credit score unions are look at these guys known for their involvement in financial literacy programs, using instructional sources and workshops to aid community members make informed monetary decisions.

Whether it's with low-interest financings, flexible repayment plans, or financial counseling, credit history unions are dedicated to assisting their participants get rid of difficulties and accomplish monetary security. With lower charges, competitive rates, personalized client service, a strong community emphasis, and a dedication to economic education and learning and aid, debt unions focus on participant advantages and empowerment.

Report this page